pay estimated indiana state taxes

If the amount on line I. To make an individual estimated tax payment electronically without logging in to INTIME.

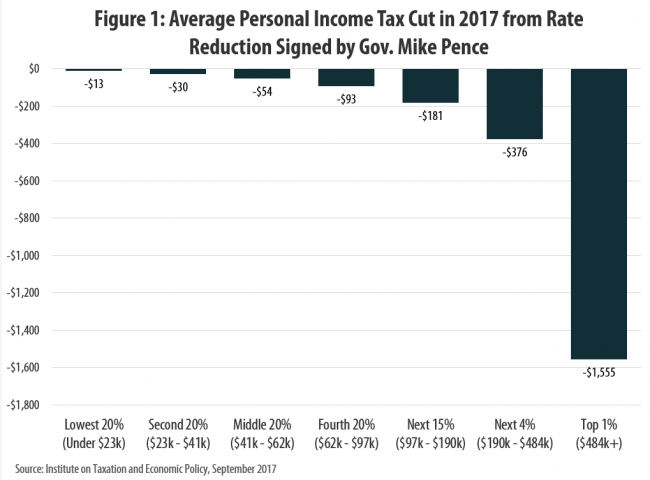

Indiana S Tax Cuts Under Mike Pence Are Not A Model For The Nation Itep

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app.

. If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. Created with Highcharts 607. 16124545 Your net payout.

Indiana Form IT-40 calls for Schedule 5 as the source for entering Estimated tax paid and you will notice that form is not currently available in Turbo Tax. Access INTIME at intimedoringov. The Indiana income tax system is a pay-as-you-go system.

Total Estimated Tax Burden 23164. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Some states also require estimated quarterly taxes.

Many corporate and individual tax customers are getting ready to make the first payment of their quarterly estimated taxes to the Indiana Department of Revenue DOR due April 18 2022. Your average net per year. How To Pay Estimated Taxes.

The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. If the amount on line I also includes estimated county tax enter the portion on.

March 16 2020 230. State of taxation intends to a due date that you can be considered an. Residents of Indiana are taxed at a flat state income rate of 323.

If the amount on line I. Percent of income to taxes 31. If the amount on line I.

Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. 240004045 After 30 payments. We last updated the Estimated.

Box 1300 Charlotte NC. This means you may need to make. What happens if you pay Indiana state taxes late.

To the Internal Revenue Service PO. Indiana Income Tax Calculator 2021. Select the Make a Payment link under the.

All counties in Indiana impose their own local. The estimated state tax cannot be deducted on schedule C they are business expenses. That means no matter how much you make youre taxed at the same rate.

If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. The following group of people should mail their Form 1040- ES. Use a pre-printed proof of estimated taxes issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated taxes.

1st Installment payment due April 18 2022 2nd Installment payment due June 15 2022 3rd Installment payment due. Indiana state income taxes for 2021 may be prepared and e-filed along with your IRS federal income tax return and the deadline for this April 18 2022Those eligible for extensions. They are however credits towards the the taxes you will owe eventually to.

Not a problem. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Estimated payments may also be made online through Indianas INTIME website.

Your average tax rate is 1198 and your marginal tax rate is. What is the penalty for paying Indiana state taxes late. Where do I send my federal estimated tax payment.

Sales Tax 1382. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. 45 state tax for in-state residents - 1237500 - 18459000.

To determine if these changes.

How To Pay Indiana State Taxes Sapling

Printable 2021 Indiana Form Es 40 Estimated Tax Payment Voucher

Indiana Dept Of Revenue Inrevenue Twitter

Estimated Tax Payment Due Dates For 2022 Kiplinger

Historical Indiana Tax Policy Information Ballotpedia

Quarterly Tax Calculator Calculate Estimated Taxes

A Review Of Indiana S State Tax Payment Plan

Llc Tax Calculator Definitive Small Business Tax Estimator

Dor Keep An Eye Out For Estimated Tax Payments

News From Indiana Across The Country And Around The World Wfyi Indianapolis

Dor Keep An Eye Out For Estimated Tax Payments

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

Fill Free Fillable Forms State Of Indiana

Reciprocal Agreements By State What Is Tax Reciprocity

State Budget Agency Commentary On July 2021 Indiana Revenue Report

How Do State And Local Individual Income Taxes Work Tax Policy Center

Gov Holcomb Announces All Hoosiers Taxpayers To Receive A Tax Refund

President Biden S Student Loan Forgiveness The Impact On Individuals State Taxes American Enterprise Institute Aei